FlexiLoans is fantastic for individuals who are seeking to borrow repeatedly as they supply added funding as you settle your loan. FlexiLoans is likewise great for Canadians with bad credit history as getting a finance does not need a credit rating check. Loan approvals are based upon a variety of different financial variables such as income. Consumers & small business owners can borrow through FlexiLoans to obtain car loans tailor-maked to their needs at a fast lane & at clear finance charges. We will certainly generate distinct ratings based upon each client profile using our proprietary credit engine which will help them avail car loans from our providing companions.

- But no interest rate will certainly be billed on the quantity which is unused.

- The current round follows a resources infusion of Rs 500 crore, which the Mumbai-based fintech company had elevated in 2016, a mix of financial debt as well as equity, of which Rs 400 crore was financial obligation financing.

- Consequently, you need to take into consideration the relevance of the info to your own circumstances and also, if needed, seek ideal expert advice.

- FlexiLoans is the first lending institution to go survive on the Google Pay system.

First step is tailor-making the kind for the merchant by an Intelligent Trip Coordinator. Second, technology is made use of to analyse the records and also data that come via in real-time. The danger versions successfully transform the information produced in the previous steps into a danger rating which establishes the qualification of a user to obtain a credit history. You can request hybrid flexi loan online via the website of the lending institution or with MyLoanCare for instantaneous authorization and fast disbursal of the finance quantity. The quantity withdrawn throughout the finance period have to be within the restriction of the amount pre-approved by the lender.

Credit Report Evaluation

We provide unsecured organization finances starting at 1% each month. If the customer approves the credit rating offer by Flexiloans, the 4th column of the techstack comes in-- finding the funding carrier. The cash can either come from Flexiloans itself, or from one of the funding service providers that we have partnered with. Message which, the individual needs to go through the normal KYC procedure. The system will certainly attach the user to an agent who will efficiently do the video KYC for the individual. If you are not signed up for online banking, you will require to head to your nearest branch to access the funds.

You may also obtain flexi individual finances offline by visiting the branch of your preferred financial institution and bajaj finance flexi loan also filling in an application. The offline application procedure resembles the on the internet application procedure-- complete an application and send your records, to name a few things. While a normal individual funding has a collection payment schedule and also the rates of interest could be lower, opting for a flexi individual funding does have its advantages. A Flexi individual car loan provides a pre-approved money limitation you can use whenever you require cash.

Profession Online

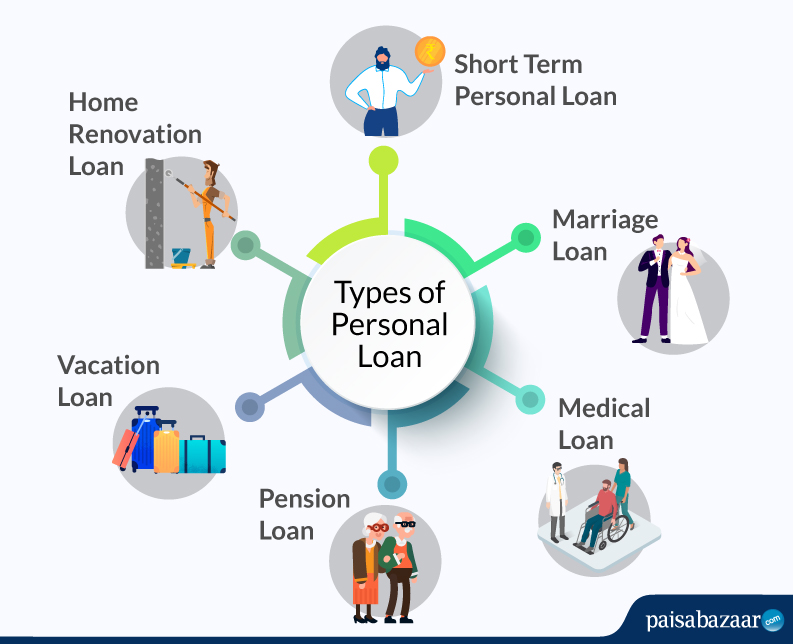

Make an application for a Clinical Car Loan with Tata Capital for moneying your medical emergency situation expenses or clearning clinical dues. Do not reconsider prior to preparing the wedding celebration of your dreams, and also we will aid you make it a truth. Obtain a Tata Capital Wedding Funding and also fund your dream wedding without draining your cost savings.

Absolutely nothing matches the excitement of possessing your all new bike. Tata Resources supplies 2 Wheeler Finances for you to possess the bike of your choice. We provide as much as 100% funding on your new motorcycle or scooter. Tata Funding offers Education and learning Loans to aid students pay their tuition costs and living expense when they are wanting to take the next steps in their education, both in India and also abroad. Depending upon the intricacy of your company, we might request for further documents, yet we'll guarantee this is as problem-free as possible.

In a Flexi finance, rates of interest is charged only on the quantity withdrawn and not on the pre-approved car loan quantity. You can pay back the financing in EMIs relied on the withdrawn quantity just. The financing can be closed before the period finishes by pre-paying the arrearage, in situation you have extra funds. Therefore, you can appreciate the versatility in terms of money withdrawal along with car loan settlement. While an immediate personal lending has its advantages, a Flexi individual loan is a lot more user-friendly. Lots of loan providers, consisting of IDFC FIRST Financial institution, offer Flexi lendings at budget friendly rates.